In his Autumn Statement, Chancellor George Osborne announced a £1 billion loan to extend the Northern Line to serve London’s forthcoming Nine Elms development.

Nine Elms is an ambitious project that will transform the last remaining area of underused land on the banks of the Thames into a mixed use site comprising offices and retail space alongside 16,000 new homes.

Meanwhile, on the other side of the Atlantic, another development – described as one of the largest ever undertaken by the private sector- officially broke ground in a derelict railroad yard on the west side of Manhattan.

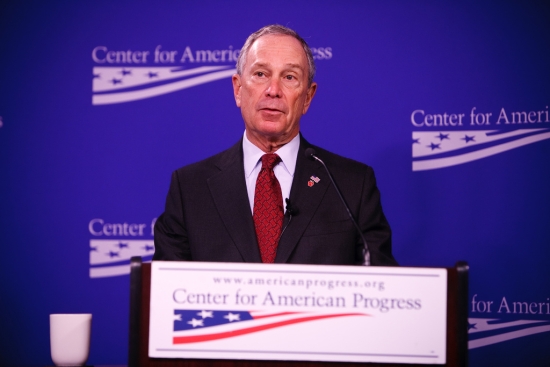

Mayor Michael Bloomberg

The riverside project, Hudson Yards, will take around 12 years to complete and cost an estimated $15 billion. Mayor Michael Bloomberg, who attended the ground breaking ceremony, was delighted a proposal that has been on the table throughout his time in office was finally underway, saying the 26 acre development represents “the future of New York City.”

The first phase of the project alone sounds impressive. This will include four mixed use buildings providing business, retail and residential space together with an arts centre and a luxury hotel. A public school, a riverfront park and a 5 acre plaza featuring a sculpture the size of the Statue of Liberty will follow not far behind, creating a ‘mini-city’ where 40,000 people will live and work.

The first tower due to be completed will be taller than the Empire State Building and provide over 1.2 million square feet of office space. Of this, 750,000 square feet has already been taken by luxury goods producer Coach. A further 400,000 square feet is rumoured to have been earmarked for cosmetics giant L’Oreal. In addition the developer Related is planning to build its own headquarters in Hudson Yards.

Both of these projects show that London and New York are determined to maintain their positions as leading international business centres in the face of challenges from rivals. In addition, the fact they are prepared to embark on such ambitious developments while the economic outlook remains uncertain says a great deal about the confidence that exists in the two cities regarding the long-term prospects for the commercial property market.

Previous Post

UK Car Sales Hit Four Year High