After remaining largely untouched by months of civil conflict in the Ukraine, British businesses could now find themselves at the sharp end of any sanctions imposed after last week’s shooting down of a commercial airliner the Wall Street Journal reports.

The deaths of 298 civilians — ten of them Britons — and the ever hardening evidence that pro- Russian separatists destroyed Malaysian Airlines’ flight MH17, is increasing the pressure on governments around the world to hit Russia with even tougher sanctions.

Whatever form those punitive actions take many businesses – and commercial property investors – may find it hard to remain unaffected.

European Union foreign ministers, due to meet tomorrow in Brussels to discuss the situation in Ukraine, are mindful that companies in the UK, Germany, France, Italy and the Netherlands have multi-billion pound business relationships with Russia.

Some German and Dutch companies have already taken action since the air crash. “New investments in Russia have been put on ice and projects that were ready to be implemented have been delayed,” said Volker Treier, head of foreign trade at DIHK, the Association of German Chambers of Commerce and Industry.

Many European analysts, however, fear that a forced decline in trade with Russia would come at a bad time for the EU. The bloc’s economy is still recovering from the euro crisis and unrest in the Middle East has unsettled many investors.

With an emergency EU summit scheduled for the end of the week and likely to produce a detailed agreement on sanctions, Britain’s intentions remain ambiguous.

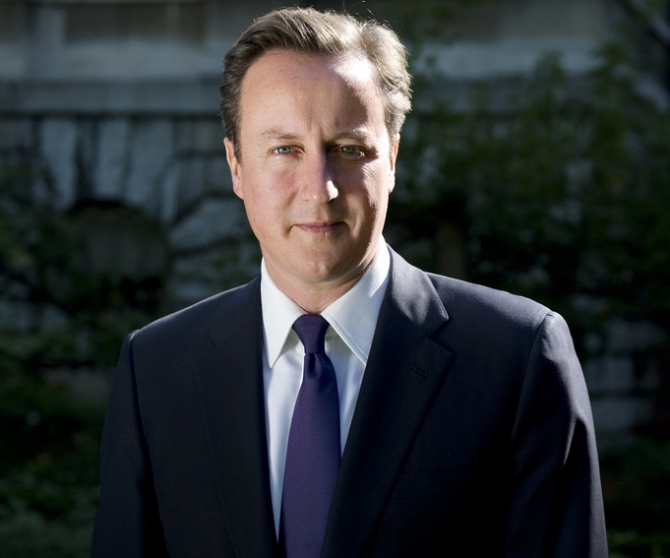

Despite David Cameron raising the prospect of further sanctions, cabinet documents leaked to the media yesterday appear to suggest a preference for restricting travel and visa access, as opposed to tougher economic measures, and signal a distinct lack of government enthusiasm to get tough with Russia.

There is a case that warns sanctions would hurt London, and therefore the UK, with the capital the obvious heartbeat of the British economy.

A huge amount of Russian assets are based in the UK. Russian wealth is placed in key western banks, whilst the popularity of strategic assets such as the London property market and even football clubs has held true for oligarchs and wealthy Russian investors for some time.

There is also speculation that the majority of the residential property sales in London with a value of £2m or more has been snapped up by wealthy foreign investors, the majority of these being Russian and Chinese. If these assets are frozen and Russians cannot buy into London properties, one of the mainstays of London’s market will be taken away — putting property prices across the city at risk.

A secondary, and arguably more serious impact, would be on British pensions. BP owns 20 per cent of Russian energy giant Rosneft, a stake that nets the oil company at least £460m a year. And with the majority of UK pension funds invested in companies such as Vodafone, Shell and BP any sanctions — especially those targeted at Russian company assets — could badly affect pension fund profits.