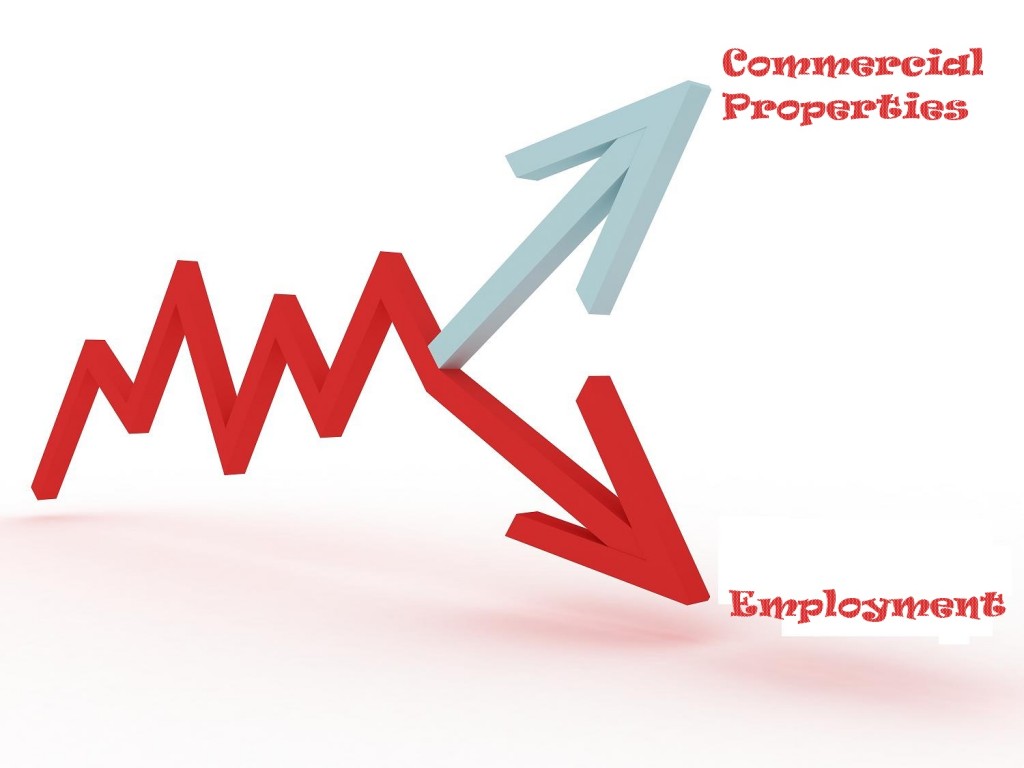

The British Retail Consortium (BRC) reported that a larger amount of new retail commercial properties opened throughout the UK in September this year; although the number of unemployed people in retail jobs still fell. So what is happening in retail commercial properties to make this happen? Movehut investigates.

The total number of new retail commercial properties in the UK in September increased by 1.1 per cent from the previous month, but the employment rate in this sector fell by 3.1 per cent in the same month. Speaking of the results, Stephen Robertson, Director General at the BRC, expressed: “With consumer spending now in recession and retail sales volumes declining, this is the biggest drop in overall retail employment in the two years since we began this survey. Redundancy rates are thankfully low but many retailers are not filling every vacancy.”

So, while new stores are opening around the UK, many positions are not being filled as there are fewer consumers going through the doors. So what does this mean for Christmas temporary staff? Mr Robertson put across: “Uncertainty and fears about Christmas trading may also be leading retailers to delay taking on this year’s seasonal staff.” As a result, even though there are still short-term Christmas jobs around, the number is considerably low compared to the previous years. The BRC found that retailers who are planning to take on extra staff during the festive period were down by 61 per cent compared to 2010 and a third of all employees will not be recruiting extra staff at all over Christmas. Also around eight per cent of people feared there would be redundancies in this sector.

The BRC also reported figures from July through to September:

Christina Tolvas-Vincent, Bond Pearce’s, Head of Retail Employment Law, expressed: “Retailers are being battered by the same economic conditions that have led to the highest unemployment rate for 17 years.”

“Seasonal hiring from those parts of retailing that gain significantly from Christmas may provide some respite, but this won’t change the underlying weakness in the retail labour market. It is possible that retailers are holding back seasonal employment until nearer Christmas compared with last year. This would explain a sharp fall this September as annual comparatives would prove tough,” Ms Tolvas-Vincent added.

Related links:

So, are any retail commercial properties doing better than the others? The BRC report showed that growth was only being made in food retailing, with employment numbers on the rise in this sector, as Ms Tolvas-Vincent, said: “Store numbers continue to increase but food retailers are almost entirely responsible for this and curiously the trend for them is towards more full-time job opportunities, with part-timers’ hours remaining almost flat. That could make things more difficult for those looking for flexible employment.”

However, experts predict that the pressure will be on for all traders in this sector, mainly due to the increase in business rates that was announced earlier this month.

Previous Post

British Summer Time… Is It Time For Change?