Sterling Property Ventures and funding partner Long Harbour have unveiled their £100m joint venture development for Birmingham’s Great Charles Place.

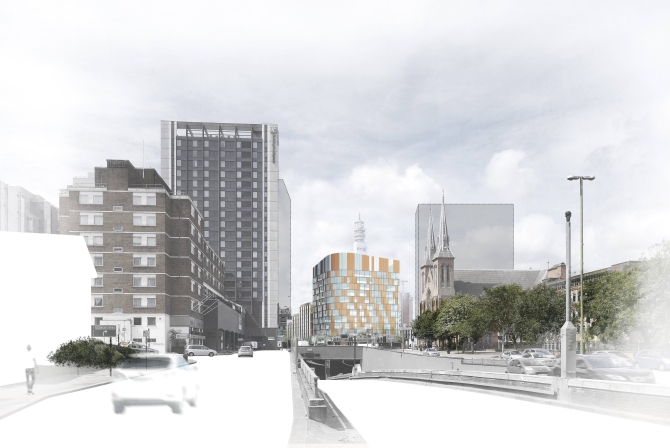

View of Great Charles Place from St Chad’s Queensway

The two-acre site — adjacent to Snow Hill railway station and bounded by Ludgate Hill and Lionel and Livery Streets — is a key part of Birmingham City Council’s Snow Hill Masterplan, linking the Jewellery Quarter with Colmore Business District. Owned by the authority it is currently a pay-and-display car park.

Specialist commercial developer Sterling signed an agreement with the council in 2013 to build on the site. A detailed planning application for the first phase of the scheme, to include 320 studio apartments, 20,000 sq ft of ground floor retail and leisure space and an 8,000 sq ft mix of small business units, will be lodged in October.

A second outline application, for a 205,000 sq ft office block with 40 basement parking spaces, will follow before Christmas.

View of Great Charles Place looking down Ludgate Hill

“Plans for Great Charles Place have been on the drawing board for two years so we are extremely excited to finally be in a position to share our vision for the scheme with the public,” commented Sterling Property’s managing director, James Howarth.

“Getting financing on board was the last piece of the puzzle and with Long Harbour committed to funding and operating the residential element of the scheme we can look forward to bringing the development to fruition.

“Great Charles Place will be a fantastic addition to the Jewellery Quarter,” he added. “Not only will it realise the potential of this strategic development site, it will help deliver some of the housing and office space so desperately needed by Birmingham.”

View from Great Charles Street

Work on the scheme is expected to start in January, with the first residential and business units available to rent from early 2018. Knight Frank advised Sterling on the funding deal and has been retained to handle both residential and commercial elements of the project.

Formed in 2009, Long Harbour is an alternative investment manager that originates long-dated, low-volatility, real estate and asset backed investment opportunities. So far it has pumped more than £200m into a range of private rented sector (PRS) projects across the UK.

Long Harbour’s investment and development manager is Rebecca Taylor. “We have been working very closely with our partner Sterling and their professional team over the past few months to ensure that Great Charles Place promotes a strong sense of community, delivers homes that are of a superior quality and creates a new and vibrant destination for Birmingham,” she said.

A closer view of the development from Ludgate Hill

“Great Charles Place represents a cornerstone investment for our fund and into Birmingham, which we have identified as a core target area for build to rent investment.”

Officially unveiled earlier this year, the £600m Snow Hill Masterplan hopes to attract up to 10,000 office jobs to Birmingham by transforming the Snow Hill and Colmore districts and attracting professional service companies with its 2.2 million sq ft of new office space.