A report released today highlights why firms in the commercial real estate sector need to speed up investment in technology innovation in order to manage their businesses and assets efficiently.

Research conducted by Altus Group – a leading provider of commercial real estate services, software and data solutions – and subsidiary ARGUS Software Inc., found that nearly a third of the 300 international firms surveyed still rely on spreadsheets for asset management purposes. Furthermore, three quarters of the industry is managing its portfolios in ‘data silos’.

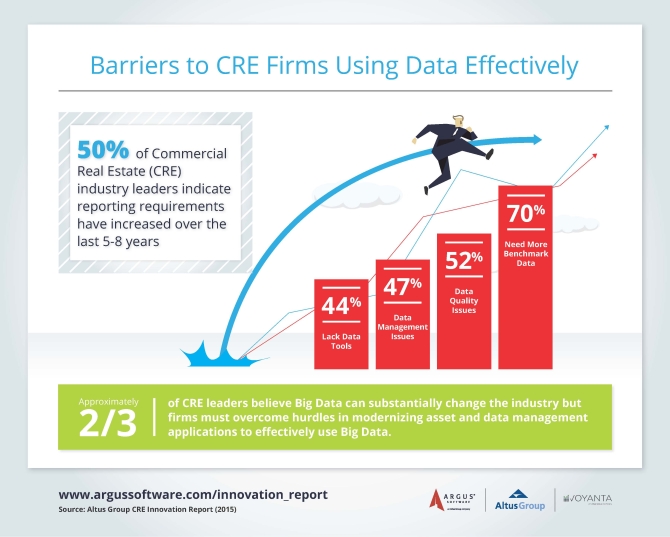

This unconnected method of managing information and assets involves the risk of human error and frequently requires date aggregation from multiple sources. This approach hampers data-driven decision making and the reporting transparency that today’s investors demand.

Real estate firms without modern data management infrastructure and systems in place are in danger of being seen as ‘behind-the-curve’, putting at risk their ability to attract the significant amount of capital expected to flow into the industry over the next decade, the report warns.

“It is clear that commercial real estate has a huge opportunity to boost productivity, unleash added innovation and increase profitability by investing in new IT and data-infrastructure solutions,” said Bob Courteau, CEO of Altus Group.

“With so much institutional capital up for grabs over the next decade, early movers in adopting best-in-class data management and reporting practices have a real opportunity to differentiate themselves from the technology ‘have nots’.”

The report also shows that the commercial real estate sector lags behind other industries in investment in information technology. As a percentage of revenue it is estimated that the sector spends around 50 per cent less than Financial Services and the Public Sector.

Consequently the industry has a long way to go in creating infrastructure that allows for improved data-driven innovation. Encouragingly however, 77 per cent of the firms surveyed say that they are now prioritising investment in the field and over two thirds recognise decision making would be improved by technology.