As property demand in London increases, developers claim the only solution is to build taller and taller. However, Transport for London (TfL) has come up with an alternative solution.

Rather than looking towards the skies for new opportunities, TfL is encouraging developers and investors to cast their eyes downwards – towards the network of abandoned tube stations and tunnels that lies beneath London’s streets.

TfL believes these buried assets could be transformed into, hotels, shops, museums and other attractions, with former Barclays executive Ajit Chambers estimating that their sale could earn the transport body around £3.6 billion.

However, it is not yet known whether TfL will choose to sell off its 750 disused tunnels as a complete portfolio or as individual lots.

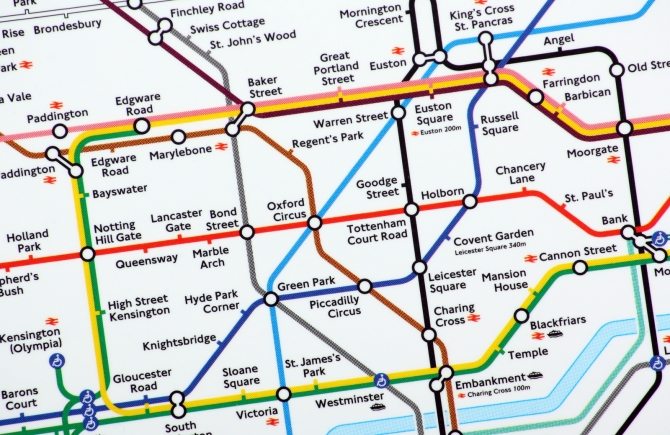

Mr Chambers first proposed the idea to transform London’s “ghost” stations in 2009, when he unearthed a map showing a number of sites suitable for renovation. Since then, deals have already been done with a number of firms to breathe life back into several of the tunnels.

Beneath Clapham North, for example, lies an extensive herb garden, while TfL has recently signed a deal with Waitrose to allow for a click and collect locker service based at Chalfont and Latimer on the Metropolitan line.

Upon discovering the map, Mr Chambers founded the Old London Underground Company as a means of realising the ambitious plans he had drawn up for 34 potential sites.

Should TfL choose to award contracts to the Old London Underground Company, Mr Chambers will initiate the “first phase” of his plan, which would see 13 flagship stations transformed into nightclubs, art galleries and potentially even a National Fire Brigade Museum as an added tourism draw for visitors.

TfL has stated that it has “no affiliation” with the Old London Underground Company, and a spokeswoman continued; “We cannot show any prejudice ahead of a public tender.”

However, Mr Chambers’ has already signed up four investors – one of whom is Duncan Vaughn-Arbuckle, the founder of wine museum Vinopolis and a big player in the London tourism market.

Developers are increasingly keen to snap up London property and with space on the surface in short supply it seems there is every chance interest in the assets may be high. However, others may ask whether these ambitious plans for a subterranean business world will ever see the light of day.

With Neil Bird

Previous Post

Work set to begin on the World’s most Advanced Factory