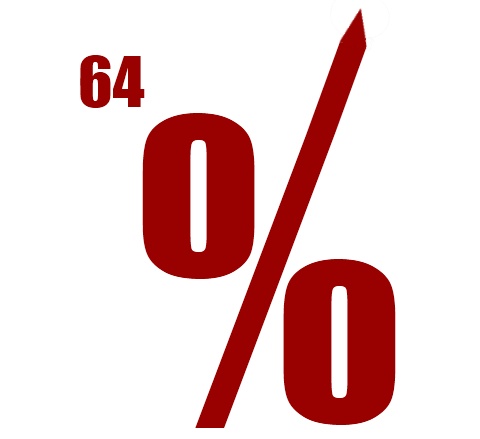

The number of commercial properties that have gone into administration has increased by 64 per cent in the first three months of this year, when compared to 2011. From this figure, retail commercial properties equates to 15 per cent of all administrations, with companies such as GAME, Blacks, La Senza and Peacocks, to name but a few, all going into administration.

Speaking of the figures, Lee Manning, spokesman at Deloitte, which offers services in Audit, Consulting, Corporate Finance and Tax, stated: “The first quarter of 2012 is particularly significant given the high profile nature of the companies we have seen enter administration: Peacocks, GAME, La Senza, Blacks and Past Times.

“As online retailing continues to grow whilst overall spending is weak, the fixed costs and poor performance of some stores drags on the overall business.”

With administrations on the increase, it can only mean that job losses have also amplified. But of the 22,000 people that lost their jobs this year due to administration, 12,000 were reemployed once the company had found a new buyer, as Mr Manning says: “The number of job losses that came as a result of these administrations was almost 10,000 out of the 22,000 employed by those companies.

“In contrast, Q1 2011 saw far lower levels of job losses. Overall, for 2011 and the first quarter of 2012 the largest 15 retail insolvencies had 2,800 stores and only 1,350 stores have survived; an attrition rate of 52%.”

However, with the quarterly rent payment date just gone – where tenants pay three months rent in advance – is the number of administrations about to increase again, as some may struggle to meet the deadline? Mr Manning thinks that “The day often sets the timing for the insolvency.”

According to Deloitte, retailers need to adapt to meet changing customer needs, and also review their commercial property portfolios – possibly considering the reduction in shop numbers by around 40 per cent over a five year period. Speaking of the recommendations, Mr Manning added: “In order to remain competitive, some retailers will need to rethink their business models to be nimble and adaptable to changing consumer trends.

“A fast-changing retail environment will require certain businesses to reassess their store portfolios, not as a matter of choice, but in order to survive.”

Do you think retailers are doing enough to stay out of administration? Do you find there are too many of the same shops in your high street and local shopping centres?